Insurance

By viewing and analyzing customers against hazard data by location, the underwriters and pricing analysts were able to better manage exposure and increase growth across every line of business—automotive, property, personal, and commercial. Location analytics created a collaborative environment that helped them reveal why and where profits were decreasing and how to reverse the trend.

Because insurers closely guard how they balance exposure within their books of business, this use case represents how Esri helps leading insurers, reinsurers, and risk managers be successful.

Benefits

Risk Analytics

ASSESS

Efficient Underwriting.

Understand risk better than ever by viewing it's exact location, past trends and modeling expected futures.

SHARE

Model Better Data.

Improve the information you use to model catastrophic loss by integrating the most current data from many sources.

MANAGE

Embrace Portfolio Diversification.

Understanding location means you can better evaluate capacity, offering the best protection while still ensuring the health of your business.

Claim Management

ASSIST

Proactive customer service.

Understanding the locations of risks and customers helps adjusters respond quickly.

ALLOCATE

Before and after an event.

Match the number and expertise of adjusters to the needs of your customers by understanding the severity of destruction.

MITIGATE

Detect fraud accurately.

Visualize where and when events occurred so you can discern which claims may not be accurate.

Solutions

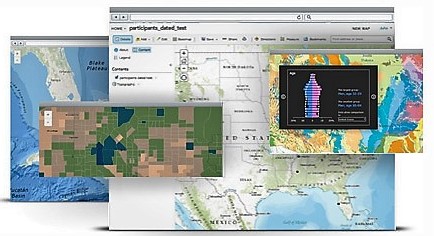

Esri Location Analytics

Makes it easy to geo-enable your business data with intuitive mapping and analytical tools. Access local hazard information at a global scale. Correlate loss severity with geography and access historical data including customer information and risk. Provide accurate quotes and uncover new markets.

Esri Demographics

Esri Demographics adds greater insight to your maps and more context to your analysis. Esri Demographics helps you understand the unique characteristics of a population based on a specific location.

ArcGIS Online

Easy access and understanding can be achieved through interactive maps and apps available through ArcGIS Online.

ArcGIS for Flood

Solutions for Flood includes software and professional services to help your organization prepare for, manage, and recover from historic rainfall.

Insights for ArcGIS

Insights for ArcGIS is a new spatial analytics experience that brings fast, powerful data exploration and discovery to everyone in the enterprise. It extends and complements the ArcGIS platform as a “system of insight”.